Contents:

- Numismatic Specifications – 1 oz Canadian Gold Maple Leaf Coin

- 1 oz Canadian Maple Leaf Gold Coin Price Today

- Historical Evolution

- Popular Buying Options

- Design Details that Make a Difference

- Limited Editions and Collectible Variants

- Security Features

- Investment Value: Why It's in Every Smart Portfolio

- Conclusion

- Frequently Asked Questions

In the world of gold bullion, few coins are of the respect and trust of the Canadian Maple Leaf Gold Coins. Introduced in 1979 by the Royal Canadian Mint, it became the first investment coin to boast a .9999 purity—a new global standard.

Today, we’re going to tell you everything about this masterpiece: value, history, coin identification, investment potential, and more!

Numismatic Specifications – 1 oz Canadian Gold Maple Leaf Coin

Specification | Details |

Issuing Country | Canada |

Mint | Royal Canadian Mint (RCM) |

First Issued | 1979 |

Composition | 99.99% pure gold (24-karat) |

Weight | 1 troy ounce (31.1035 grams) |

Diameter | 30.00 mm |

Thickness | 2.80 mm |

Face Value | 50 Canadian Dollars (legal tender) |

Obverse Design | Effigy of King Charles III (earlier: Queen Elizabeth II) |

Reverse Design | Maple Leaf |

Edge | Reeded |

Finish | Brilliant Uncirculated (BU) |

Security Features | Radial lines, laser micro-engraved maple leaf, Bullion DNA technology |

Packaging Options | Assay card (tamper-evident), tubes of 10, monster boxes of 500 |

IRA Eligible (US) | Yes |

RCM Mark | Yes – laser micro-engraved maple leaf with year inside (since 2013) |

1 oz Canadian Maple Leaf Gold Coin Price Today

As of May 2025, the coin price today sits around $3,223.87 USD, depending on market fluctuations and dealer premiums. This value is tied directly to the gold spot price, which remains a strong hedge against inflation and economic volatility.

Weight | Estimated Value (USD) | Common Uses |

$3,223.87 | Investment, long-term storage | |

1/2 oz | ~$1,611.93 | Diversified portfolio strategy |

1/4 oz | ~$807.09 | Entry-level gold holding |

1/10 oz | ~$323.42 | Gifting, fractional investment |

1/20 oz | ~$160.15 | Collectors, micro-investment |

1 gram Gold Maple Leaf | ~$92–98 USD | Budget-friendly collecting, gift items |

Historical Evolution

The Canadian Maple Leaf gold coin was introduced in 1979 as a direct response to the dominance of the South African Krugerrand. At the time, international sanctions limited the Krugerrand’s distribution due to apartheid, opening a window for other mints.

Canada seized the opportunity by launching the 1 oz Canada Maple Leaf gold coin, striking it with .999 purity—already purer than its South African rival. By 1982, the Royal Canadian Mint pushed boundaries again by raising the purity to .9999 (24-karat) - the first mass-produced coin of its kind.

Over the years, the design remained remarkably consistent. The reverse always features the national symbol—the maple leaf—while the obverse showcases the reigning monarch:

1979–2023: Queen Elizabeth II, with updates in her portrait across decades

2024–present: King Charles III, a new royal era for the coin

Today, the Canadian gold Maple Leaf price remains one of the most closely tracked bullion indicators in the gold market.

Popular Buying Options

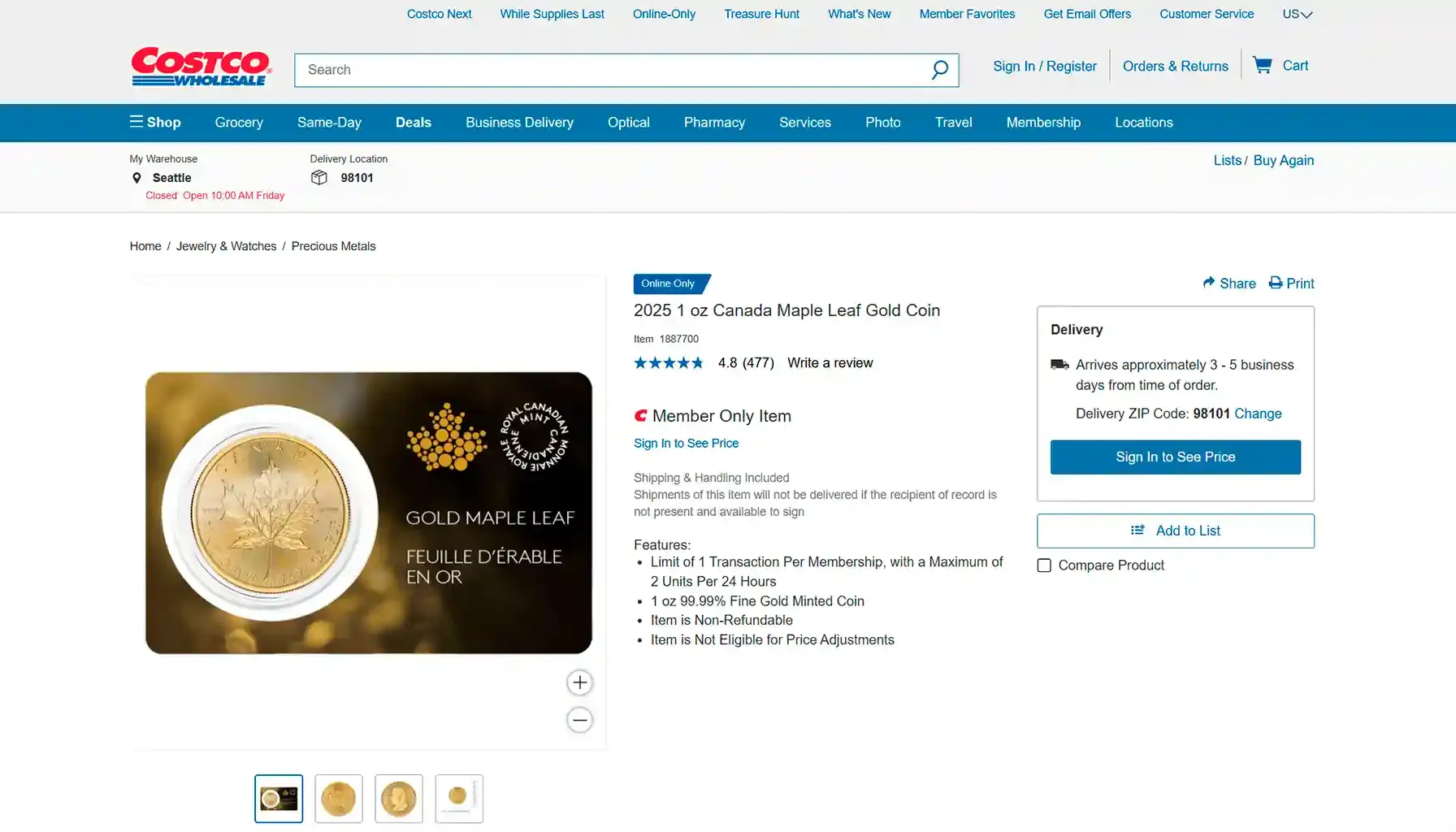

Yes, even Costco sells gold now—and the 1 oz Maple Leaf Gold Coin Costco edition has taken investors by surprise with its competitive pricing and free shipping (for members). Whether you're browsing big retailers or niche dealers, the coin is broadly accessible:

Costco Gold Maple Leaf: Frequently sold online in tamper-evident assay packaging

APMEX: Offers both circulated and BU coins, including bulk options

JM Bullion: Carries current-year and historic releases

Bullion Exchanges: Good source for fractional sizes like 1/20 oz and 1 gram coins

Kitco & TD Precious Metals: Trusted Canadian vendors

The Costco Phenomenon: Should You Buy Gold from Costco?

In a surprising twist, Costco entered the precious metals market—and yes, they sell real 1 oz Canada Maple Leaf gold coins.

The phenomenon began when members discovered they could buy gold online directly from Costco’s website. While availability fluctuates and often sells out within hours, it raised a compelling question:

Should you buy your gold Canadian Maple Leaf coins from Costco?

Pros:

Competitive Pricing: Costco often undercuts traditional dealers due to volume purchasing.

Free Shipping: Most coins come with insured delivery included in the price.

Tamper-Evident Packaging: Coins are typically sold in RCM assay cards.

Cons:

Membership Required: You’ll need a valid Costco membership to purchase.

Quantity Limits: Usually restricted to 1–2 coins per customer.

Delivery Delays: Some buyers have reported wait times of 7–10 days.

Despite these caveats, the Costco listing has boosted the visibility and mainstream acceptance of bullion investing. For many, it’s a first step into the world of physical gold ownership.

Design Details that Make a Difference

Every 1oz gold Maple Leaf coin price is more than just a piece of precious metal—it's a work of art.

Obverse: Features the reigning monarch (King Charles III as of 2025)

Reverse: The classic sugar maple leaf—clean, powerful, Canadian

Finish: Radial lines for enhanced security and visual depth

Engraving: Laser micro-etched leaf with year and mint mark

The design hasn’t changed much because it doesn't need to.

Limited Editions and Collectible Variants

While the standard 1 oz gold Maple Leaf coin value is rooted in bullion pricing, some special editions carry premiums far above spot. These collectible Canadian specimens combine numismatic rarity with the coin's already exceptional gold content.

2005 “Five 9s” Edition (.99999 Purity)

Only a small number minted

Features ultra-high purity

Highly prized among purist collectors

2010 Olympic

Issued to commemorate the Vancouver Winter Olympics

Olympic logo and special privy marks on reverse

Limited mintage increases collector demand

25th & 30th Anniversary Editions

Feature unique inscriptions and privy marks

Sold in special packaging with certificates

Available in both BU and proof finishes

Maple Leaf Forever Series

Artistic reimagining of the maple design

Low mintage runs, often fewer than 10,000

Ideal for collectors who value design variety

Security Features

The gold coins Canadian Maple Leaf are lauded for being the most secure bullion coins globally. Key features include:

Radial line pattern

Micro-engraved security mark

Bullion DNA technology (Dealer Network Authentication)

These features make it extremely difficult to counterfeit a gold Maple Leaf 1 oz coin, increasing buyer confidence and resale value.

Investment Value: Why It's in Every Smart Portfolio

The coin is a go-to for both seasoned investors and beginners. Here's why:

High Liquidity: Accepted by dealers worldwide

Exceptional Purity: .9999 fine gold — among the purest in the world

Affordability: Slight premiums over spot compared to American Eagles

Resale Market: Easily resold with minimal depreciation

IRA Eligible: Recognized in precious metal retirement accounts

Value Appreciation Over Time

It’s a long-term wealth preservation tool. Since its debut in 1979, this coin has gained popularity not just for its .9999 gold purity, but for its resilient market 1 oz Canadian Maple Leaf gold coin value across decades.

Historic Value Growth: Then vs Now

Year | Gold Spot Price (USD/oz) | 1 oz Maple Leaf Gold Coin Price |

1980 | $594 | ~$620 (with premium) |

1990 | $384 | ~$400 |

2000 | $279 | ~$295 |

2010 | $1,405 | ~$1,480 |

2020 | $1,770 | ~$1,860 |

2025 | $2,340 (as of May) | ~$3,223.87 (with current premium) |

Insight: In 25 years, the price today is over 11x higher than in 2000. Even after inflation adjustment, this coin has outperformed cash savings and many traditional bonds.

Comparison with Other Investments (2000–2025)

Asset Class | Average Annual Return |

Canadian Maple Leaf Gold Coin | ~8.7% CAGR* |

S&P 500 Index | ~6.3% CAGR |

U.S. Real Estate (avg.) | ~4.8% CAGR |

Government Bonds | ~2.0–3.5% CAGR |

*Compound Annual Growth Rate (approx.)

While the S&P 500 may outperform gold in short bullish cycles, the gold coin discussed holds its value better during volatility, currency devaluation, or geopolitical shocks.

Why Coins Outperform ETFs During Crisis Periods

Gold-backed ETFs like GLD mimic the spot price, but during real-world events (bank failures, inflation surges), physical coins surge in premium value due to scarcity and demand spikes.

For example:

During 2008 and 2020, coin premiums rose by 15–25% above spot

Unlike ETFs, you hold and control the asset physically—no counterparty risk

Conclusion

If you're seeking a secure, globally recognized, and beautifully crafted way to hold physical gold, the Maple Leaf gold coin 1 oz format is nearly unbeatable.

Want to know if your coin is real or worth more than spot? Try tools like Coin ID Scanner to get fast, accurate evaluations using only your smartphone camera.

Frequently Asked Questions

How does the gold coin compare to silver and platinum versions?

While the 1 oz Canadian Maple Leaf gold coin is the flagship, the Royal Canadian Mint also issues silver, platinum, and even palladium versions. The gold version is the most widely recognized and traded, but silver ones are popular among smaller investors due to their lower entry price and high liquidity. Platinum versions are rarer, often minted in smaller quantities, and appeal more to advanced collectors or diversification-minded investors. Difference: Only the gold ones boast the full combination of .9999 purity, historical significance, and global liquidity.

What’s the difference between bullion and proof coins?

Most investors are familiar with bullion versions of the coin, which are struck once and meant primarily for investment. Proof versions, however, are struck multiple times with polished dies, giving them a mirror-like finish and finer details. Proof: Limited mintage Packaged in presentation boxes Typically carry higher premiums over the price today Read more about the topic: Universal Coin & Bullion.

Are they accepted worldwide?

Yes. It is considered one of the most internationally recognized forms of gold bullion. Its consistent purity, backed by the Government of Canada, makes it easy to trade across North America, Europe, Asia, and beyond. In fact, it often commands lower spreads when selling, compared to lesser-known or region-specific coins. Whether you're holding the 1 oz gold coin or fractional versions, its recognition makes it one of the most liquid physical assets globally.

Can I include these gold coins in a retirement account?

In the U.S., 1 oz ones are eligible for inclusion in a self-directed IRA (SDIRA), provided they meet IRS requirements. The coin’s .9999 purity qualifies it under the IRS’s fineness standards for retirement assets. Only ungraded, bullion versions are accepted. Proof or collectible ones may not be eligible unless specifically IRS-approved. Always consult a certified SDIRA custodian before purchasing.

What is the best time to buy a Canadian gold piece?

The price closely follows the spot price of gold, which is influenced by macroeconomic factors like inflation, interest rates, and global uncertainty. Best buying opportunities often arise when: Gold dips due to short-term economic optimism Seasonal demand drops (typically summer) Dealer promotions offer lower premiums Investors track both spot pricing and dealer premiums to identify the optimal moment to purchase. If you're cost-sensitive, you might even monitor bulk deals or flash sales at places like Costco listings or reputable online dealers.