Contents:

Silver coins are among the most desirable numismatic creations that may captivate the attention thanks to their composition alone. Although it is the appearance that usually boosts the worth of any coin, the influence of precious metals is undeniable, especially when combined with special attributes like minting errors or unique designations.

However, silver cannot be considered only a fine metal that looks great when used in minting. In turn, it may turn into an investment tool that is to bring you wealth without a doubt.

As major banks and analysts release long-term price forecasts, the debate heats up: how high could it really go in the next five years? What will be the price of silver in 2030? And how to check coin value when the only known variable is the silver worth?

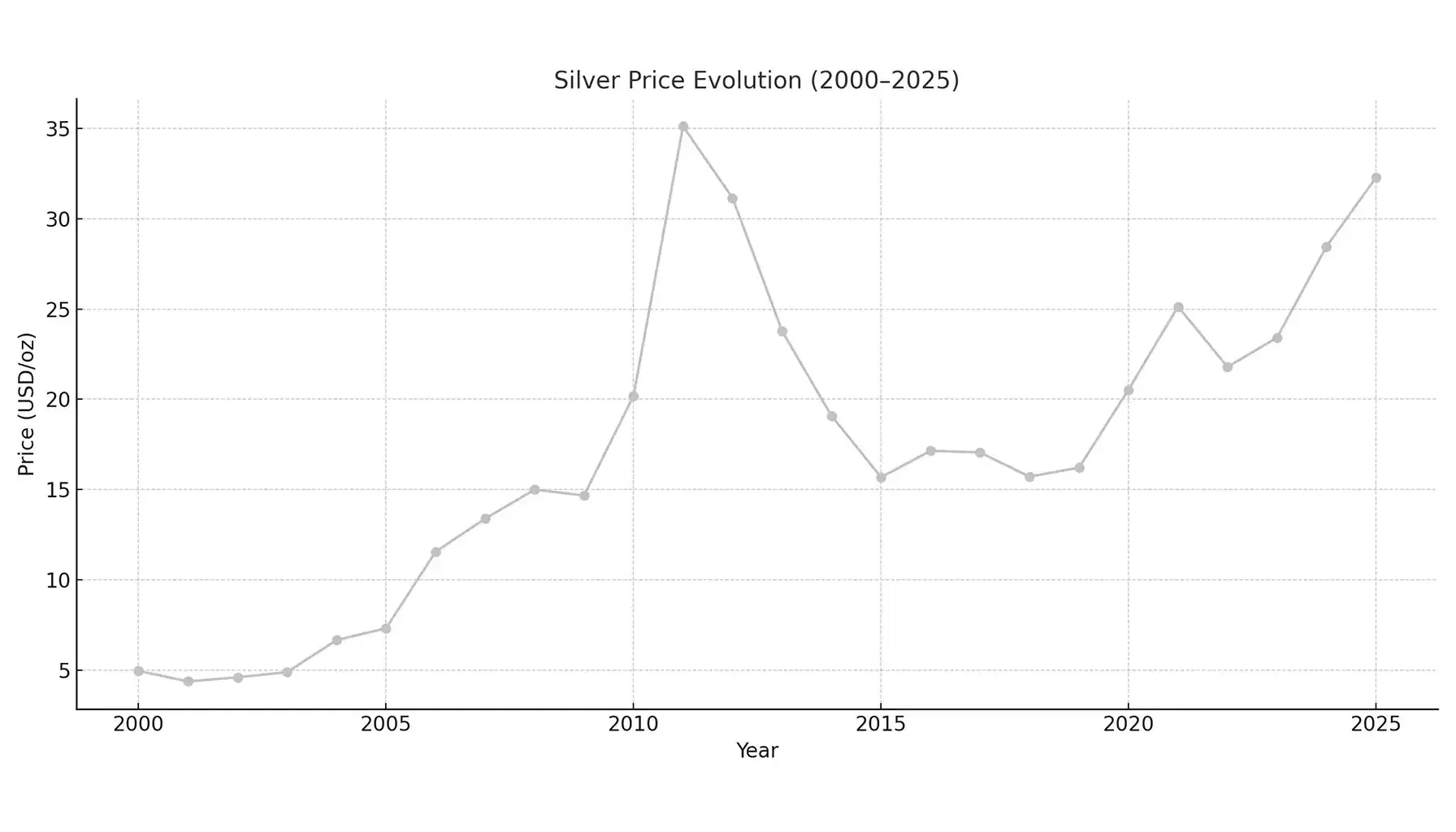

The Current Silver Price and Recent Trends Revealed

As of June 2025, the silver spot price sits at $36.47 per ounce, according to APMEX. This demonstrates a significant increase in the value from the 2023 average, which was around $24 per ounce. Such a climb may be justified by numerous macroeconomic forces, industrial demand, and the overall situation on the market. The economy is a living organism that cannot rest unchanged forever.

Recent trends show tightening supply chains and growing average prices on physical silver, which may mean that spot price increases may be underpinned by both demand-side and supply-side pressures. Let us take a look at the silver price forecast 2025 to 2030 and see which factors do affect the worth.

Related article: Gold and Silver Coins: Top Picks for Success

Silver Price 2030: What Experts Say

Although the precious metals value should not vary from source to source, it surely does. The market is uncertain about what may come next, leading to instability and inconsistency in the market. Goldman Sachs, for instance, has noted its growing demand in clean energy technologies. While they have not issued a firm $100/oz target, their outlook points toward a sustained uptrend, especially if industrial use continues to accelerate.

Bank of America has previously speculated that under extreme monetary expansion and inflationary pressures, silver could approach triple digits one day. However, they caution that such outcomes depend on broader systemic shifts, including continued global de-dollarization or severe supply disruptions. This may come down to politics, which are strongly connected with the dollar as its symbol or representative.

From a more conservative perspective, institutions like Fitch Solutions predict moderate growth, estimating the metal could reach $40–$50/oz by 2030. However, things may change, as they state, for technologies, economies, and other establishments may either prosper or collapse. The outcome is yet to be formed.

5 Surprising Factors That Could Drive Silver Prices Higher

Silver has never been an underestimated metal. In turn, this has always been an instrument to preserve wealth and stabilize the economy through its exceptional physical properties. Below are the factors that are expected to prove to be the real drivers of the next bull run.

Persistent Inflation and Currency Debasement

Inflation is a driving force of any change that might occur in the market. Unfortunately for us, inflation means a natural process that cannot be stopped in an instant. As soon as central banks all around the world have to tackle the long-term consequences of money-printing and debt expansion, the purchasing power of fiat currencies continues to erode.

Indeed, the inflation rates have cooled from post-pandemic highs, but the damage to the monetary system is still persistent. This is when silver enters the game. Investors who sense the ongoing inflation acceleration turn to assets like silver to preserve their wealth. More importantly, this metal tends to outperform gold in high-inflation, risk-on environments due to its industrial component. Silver is universal, beautiful, and omnipresent.

The Green Technology Revolution

This might be the most underestimated factor where silver plays a crucial role. In fact, this metal is essential in the production of solar photovoltaic (PV) cells, where it is used for its superior conductivity. Green technologies are vital for the ecosystem, and so is silver.

The predictions estimate that solar panel production alone could account for over 25% of industrial silver demand by 2030 (with the use of this precious metal in electric vehicle components, battery systems, and smart grid technology, not to mention).

EUR/USD Exchange Rate

For most people, it becomes obvious that exchange rates also influence the position of silver, its status, and perspectives. As such, it is traded globally, but prices are quoted in US dollars only, which is why the fluctuations in the dollar's strength affect the affordability of precious metals and, hence, the demand.

Here is the rule: a weaker US dollar tends to make silver cheaper for international buyers, turning it into a more desirable material to trade. All in all, volatility in the EUR/USD pair plays a crucial role in silver’s trajectory and its "popularity".

Speculative Activity in the Futures Market

The silver futures market is a powerful force that can amplify price movements in either direction. Compared to physical trading, the futures market enables large speculative positions with relatively low margin requirements, which may lead to price swings over time.

Thanks to retail traders, funds, and various related institutions, this metal became a more volatile asset. Speculative flows into silver contracts might be a catalyst for real-world price increases in the end.

Mining Supply Constraints and Declining Ore Grades

Although the popularity and demand are expected to rise, the supply side of the silver equation is quite challenging. Silver mine production has almost been suspended in recent years, and new large-scale developments have become overly rare. In fact, the main part of the deposits have been exploited, and ore grades are declining (=more rock but less metal).

Besides, it gets harder to bring new silver projects in because of newly established environmental regulations, water usage limits, and community opposition. Today, silver mines are the byproducts of other mining operations, and this is the reason why silver production may be slowed down at any time. Silver is scarce, and the silver price prediction 2025- 2030 does not seem to be bright, though.

To learn more about a peculiar investment tool, read our article: Glimmer and Shine: Modern and Vintage Silver Dollars

Can Silver Really Hit $100/oz by 2030?

When one refers to the expected silver price in 2030, the idea of silver reaching $100/oz might seem like a hopeful prediction rather than a grounded analysis. This is why Coin ID Scanner, the coin identification app with comprehensive market analysis tools we aim to rely on, provides three grounded approaches for estimating where silver could be in the next five years.

Growth Rate Projection

This is what one should calculate by examining silver’s historical price growth, the most obvious means of estimation:

From 2020 ($20/oz) to mid-2025 ($36.47/oz), silver has grown at a compound annual growth rate (CAGR) of approximately 12.7%.

If this growth rate continues, by 2030, Ag could reach:

$36.47 × (1 + 0.127)^5 ≈ $66–$70/oz

To reach the price of silver 2030 of $100/oz, it would need to rise at a CAGR of 14.4% from 2025 onward. This is ambitious, but not unthinkable, though.

Inflation-Adjusted Peaks

Silver's highest rate was just under $50/oz in April 2011. This is immense, by the way. But in real, inflation-adjusted terms, the 1980 peak would be worth $160+/oz today, depending on the inflation metric used.

Taking this into consideration, $100/oz is not unprecedented. Consequently, this precious metal may naturally overgrow this level and get even more valuable than ever.

Supply & Demand Forecasts

As we have covered before, the demand cannot be stopped, since sources like clean energy (e.g., solar one), electronics, and the like, require silver to exist. If the annual silver deficit widens to 100 M+ ounces, which some analysts predict, the market could become tighter than it has been in decades.

In this case, market imbalances could justify prices in the $75–$100+ range. However, it is not guaranteed anyway. The world is changing, and events that lead to price growth cannot be predicted from afar.

Valuing Coins When Only Silver Matters

When the only thing you know about your coin is its silver content, you can still estimate its intrinsic (melt) value precisely:

Find the Silver Content

Check the coin’s silver purity and weight. For instance, a US Morgan dollar contains 0.7734 troy ounces of Ag.

Use the Current Spot Price

Multiply the Ag weight by the current spot price. Here is the example:

0.7734 oz × $36.47 = $28.22 melt value

Keep in mind, it is only the melt value. The genuine worth of a coin can be much higher, depending on other notable factors like the grade, mintage, type, and demand.

The silver price 2030 prediction is something of a solid foundation: it relies on long-term price growth, rising industrial demand, constrained supply, and inflationary pressure.

For coin enthusiasts, this means that the worth of silver coins (especially those with exceptional numismatic appeal) will only solidify. This is how even common bullion coins could bring you wealth one day. Keep track of the rates and rest assured, your investments are worth it.